| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

For much of the past decade, platinum has been the overlooked royal in the court of precious metals. While gold has glittered under the spotlight and silver has danced through speculative fervor, platinum has often played the quiet counterpoint—valued, yes, but rarely celebrated. Until now.

In recent weeks, something has shifted. Inflows are accelerating. Options markets are firing. Futures volumes are soaring. And vaults—those silent witnesses to sentiment—are being restocked with uncharacteristic aggression. Platinum, it seems, is not waiting for an invitation. It’s reclaiming its seat.

A 99% Year-to-Date Surge: Platinum Options Steal the Show

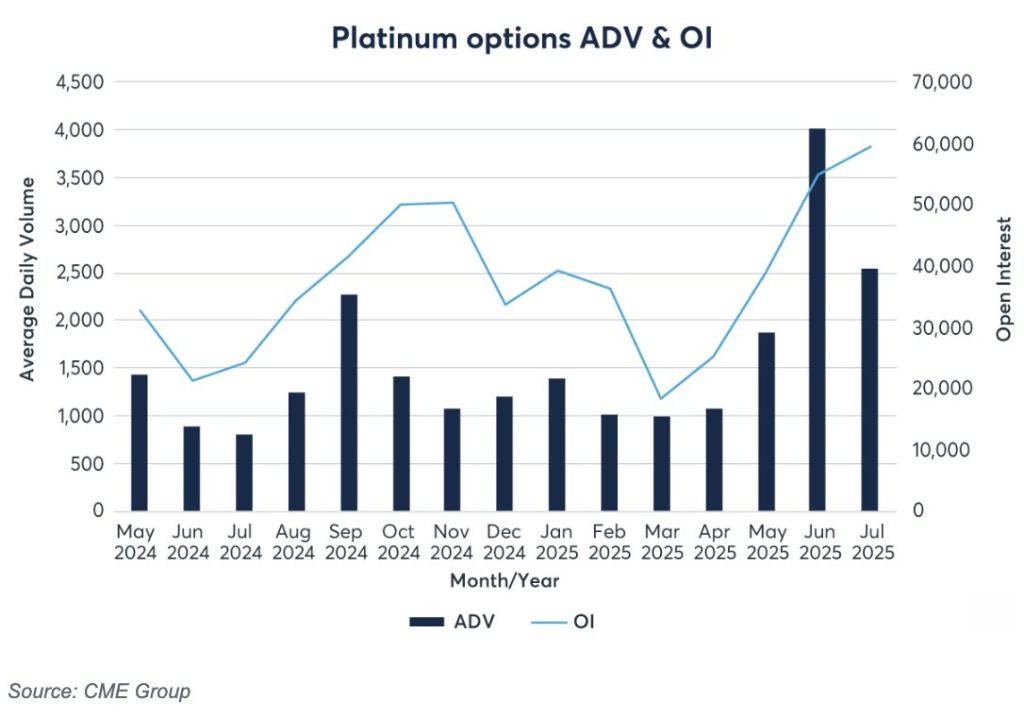

As of July 25, platinum options trading is up a stunning 99% year-to-date. The pace has been building steadily, but June was a true inflection point: over 4,000 contracts traded per day, setting a monthly record. By July, open interest surpassed 60,000 contracts, marking the highest tally in years.

These aren’t just statistical blips. This is informed money moving in size. Market participants—ranging from industrial hedgers to macro-driven funds—are increasingly turning to platinum not just as a hedge, but as a high-conviction play.

As Hugo Pascal of InProved Metals puts it, “When you see OI in platinum options rise this rapidly, it’s not just about volatility. It’s about positioning for an event the market isn’t fully pricing in yet. Platinum is no longer the sideshow—it’s the signal.”

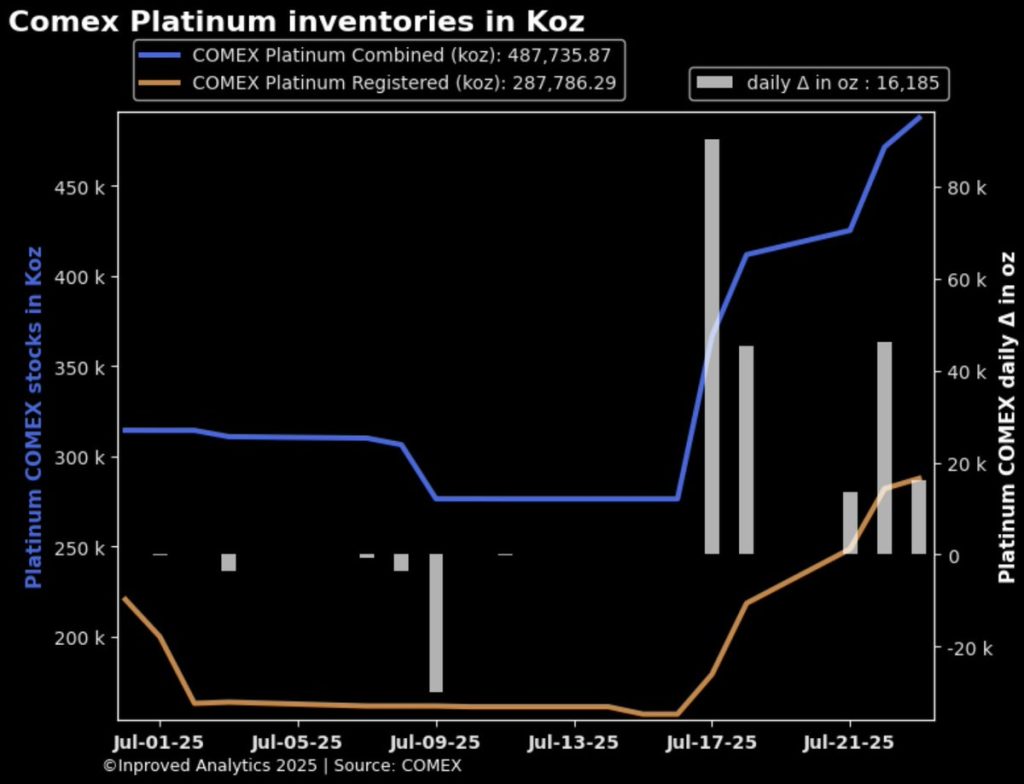

While the derivatives market lights up, physical demand isn’t staying behind. The COMEX platinum vaults have seen inflows for five consecutive days, a streak not seen since early 2022. As of July 25, total vault holdings reached 487,736 ounces, up 76.5% over just a matter of sessions.

More telling still, the registered category—metal that’s actually available for delivery—has increased by 83.3% to 287,800 ounces. That’s not just reshuffling metal for optics. That’s preparing metal to meet the growing delivery risk posed by surging speculative and institutional positioning.

Earlier in the week, on July 24, Loomis received 42,700 ounces, while JPMorgan shifted 30,105 ounces from the eligible to the registered category on July 23. These shifts within vaults are critical: eligible metal is stored but not available for settlement, while registered metal is prepared for delivery on the exchange. The movement signals that COMEX is bracing for more physical demand—and fast.

Zooming out, the wider metals complex is also experiencing a volume renaissance. The CME reported a record quarterly average daily volume (ADV) across metals, coming in at 943,000 contracts. That includes platinum futures ADV of 44,000 contracts, a sharp increase that solidifies the metal’s place in the broader trading landscape.

This surge in platinum trading comes against a backdrop of rising macro uncertainty—U.S. tariffs, China’s industrial reboot, and a renewed focus on supply chain resilience. In short, platinum is re-entering the global conversation not just as a commodity, but as a strategic asset.

And unlike its cousin palladium, whose story has been largely auto-sector driven, platinum’s case is more balanced—bridging industrial demand with investment hedging and, increasingly, safe-haven appeal.

Even as trading volumes spike and vaults fill, platinum’s pricing structure remains nuanced. As of late July, platinum was trading at $1,447.14/oz, up 2.3% above LBMA. That premium is modest compared to gold or silver, but it’s the direction—and resilience—that’s key.

Historically, platinum has struggled to maintain a strong premium over LBMA benchmarks, largely due to uneven liquidity and thinner global trading. But as Shanghai’s appetite grows and COMEX inventory tightens, those premiums could become more volatile—and more instructive.

Pascal weighs in: “Platinum premiums have always lagged due to structural factors. But with inflows rising and OI spiking, the tide is turning. We could see sharper premium surges ahead, especially if physical demand continues to outpace delivery.”

What’s Driving This Resurgence?

Several catalysts are converging.

1. Industrial Tailwinds: With hydrogen fuel cell development accelerating and green hydrogen production scaling globally, platinum demand from non-auto sectors is expected to grow sharply in the next decade. China, in particular, has ramped up state support for alternative energy storage, and platinum sits at the center of that ecosystem.

2. Investment Rotation: As gold dominance in the precious metals complex falls—now down to 58.7%—investors are rebalancing portfolios toward overlooked assets. Silver has benefited, yes. But platinum is quietly attracting allocators seeking asymmetric returns.

3. Vault Behavior: The shift from eligible to registered metal isn’t just technical—it’s a bet that physical settlement risk is growing. In a world of increasing geopolitical instability, investors are asking a vital question: “If I want delivery, can I get it?”

4. A Laggard No More: From a technical standpoint, platinum has been undervalued for years relative to gold. But now, with the gold-to-platinum ratio nearing 2.29:1, traders are sensing opportunity. That ratio has tightened dramatically, signaling a potential reversal of years-long underperformance.

For bullion investors, the platinum resurgence is more than just a curiosity—it’s an invitation. It invites a deeper review of allocation strategies, particularly for those seeking to hedge not just inflation or currency risk, but industrial and geopolitical volatility.

Buying platinum at the cusp of an institutional reawakening could provide asymmetric upside, especially with options markets now offering a surge in liquidity. Moreover, the physical market appears to be catching up, with rising vault flows and a more transparent premium environment.

InProved’s vault network in Singapore has also begun seeing rising inquiry for platinum—particularly from family offices and high-net-worth investors who are increasingly looking beyond traditional gold-silver portfolios.

The past week has offered one of the clearest signals yet that platinum is no longer in the shadows. Whether it’s the sharp rise in COMEX inventory, the options market frenzy, or the increasing institutional allocation, this metal is beginning a new cycle of relevance.

As Hugo Pascal puts it, “This isn’t about catching a trend—it’s about recognizing a shift. Platinum is not a niche play anymore. It’s a strategic asset that’s finally being priced accordingly.”

If you’re ready to diversify your metals portfolio with real, allocated platinum, look no further than InProved. Our clients enjoy access to some of the world’s lowest LBMA prices, deep vaulting security in Singapore, and real-time visibility into premiums between London and Shanghai.

📲 Download our mobile app or visit InProved.com today to start building your portfolio—with platinum, silver, or gold—all at the most competitive spreads in Asia.

Because when the world reawakens to platinum, you’ll want to be ahead of the trade.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions