| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

When the world’s equity markets are flirting with all-time highs and volatility spikes 22%, one asset quietly signals that something deeper is shifting: gold.

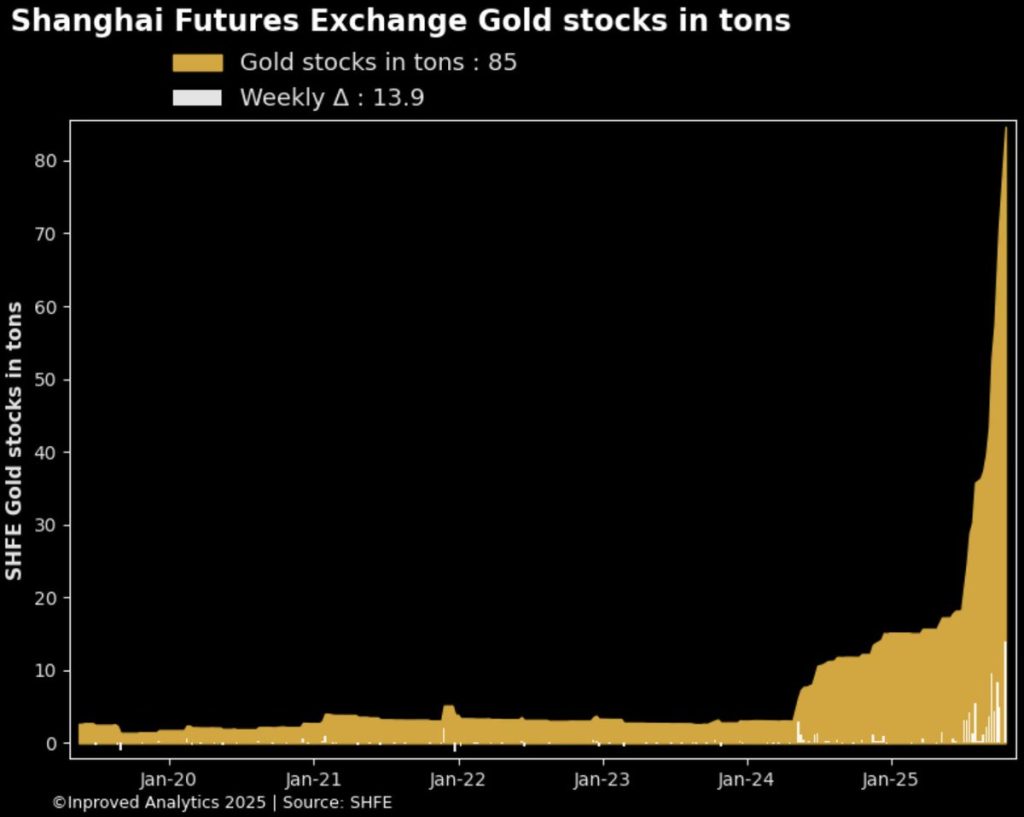

In the first half of October, gold has entered what traders across Shanghai are calling “Uptober” — a month marked by a resurgence in physical demand, record trading activity, and vault inflows unseen since before COVID-19. The data from China tells a story that’s hard to ignore: premiums turning positive, volumes exploding, and inventories swelling at historic rates, even as Western markets remain fixated on stocks and yields.

For conservative investors, this alignment of fundamentals and sentiment isn’t just noise — it’s the early architecture of a new gold cycle.

After several weeks of muted activity and mild discounts, Chinese gold premiums have turned decisively positive — trading between +0.12% and +0.47% above the LBMA benchmark.

While the margin might look small, its implication is profound: local buyers are once again paying more than the global benchmark for physical gold.

That change marks a critical shift in sentiment. During periods of sustained discounts (as we saw through August and September), local refineries and wholesalers tend to sit on the sidelines. But once the premium flips, even slightly, they rush to restock — a cycle that amplifies itself as inventory shrinks and prices climb.

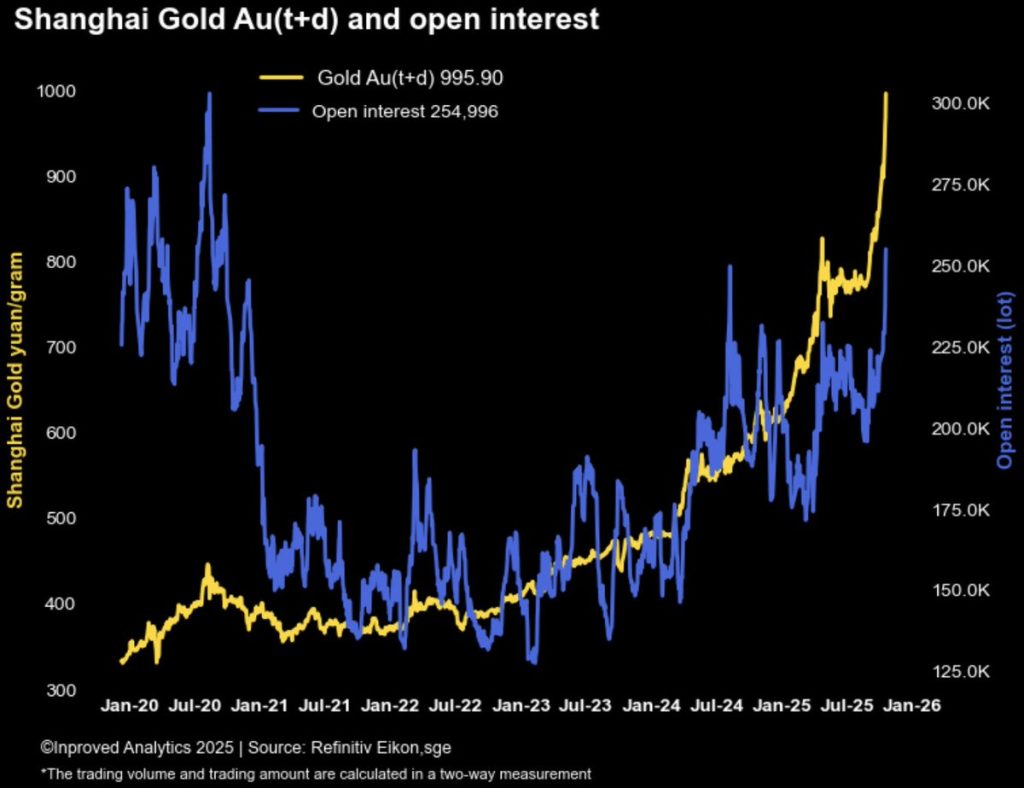

This time, the premium reversal coincides with record-breaking participation on the Shanghai Gold Exchange (SGE).

The physical proxy contract AU9999 has seen a daily average trading volume of 20.18 tons in October — a staggering 55% above its five-year average.

As Hugo Pascal observed in his weekend note: “When Chinese gold starts trading at a premium and volumes explode together, that’s not noise — that’s demand momentum turning into monetary momentum.”

Nowhere is that demand clearer than in Shanghai’s vaults.

Last week, the city’s gold inventories surged 13.9 tons week-to-date to 84.6 tons (2.7 million ounces) — the largest inflow ever recorded. On Friday alone, 3.65 tons flowed into the system.

For context, the weekly average inflow over the past year has been closer to 2.4 tons. This tenfold acceleration signals that institutional demand — not just retail — is behind the move.

Vault inflows at this scale often precede a multi-week physical shortage in the local wholesale market, as traders and refiners front-load supply ahead of the next pricing phase. It’s also worth noting that these inflows came despite the yuan strengthening modestly and interest rates holding steady — a sign that gold’s bid isn’t purely speculative, but structural.

On the derivatives side, gold open interest (OI) on the SGE has soared to 255,000 contracts, matching levels last seen during the pandemic-era liquidity panic. Back then, it marked a turning point — when financial repression and inflation hedging collided to propel gold toward $2,000.

This time, the setup feels eerily similar. The Au(T+D) contract — China’s most liquid deferred settlement product — closed at $4,346.6 per ounce, mirroring COMEX’s rising forward curve.

That number may look lofty, but it reflects the growing gap between available deliverable gold and notional exposure.

When OI climbs alongside physical premiums, it often signals the convergence of speculative and real-world demand — a precursor to tightening supply chains and, eventually, higher global benchmarks.

In the background, something unusual is happening in global risk markets.

The VIX index spiked 22% this week to 25.3, yet stocks remain within a few percentage points of their all-time highs. Historically, that kind of divergence doesn’t last long. When volatility rises while equities hold, it means hedging demand is growing faster than conviction — a sign of latent fragility.

Gold, meanwhile, has detached from that complacency. Prices have climbed 8% week-to-date, a move that might look modest next to the chaos of 2020 but is remarkable given the broader risk-on backdrop.

In Pascal’s words: “When volatility jumps and equities don’t fall, that’s the sound of paper ignoring what money already knows. And gold is money.”

This dynamic — rising vol, flat equities, firm gold — is historically rare. It appeared briefly in March 2018 before the U.S. yield curve inverted, and again in mid-2020, just before the metal surged to all-time highs.

At first glance, the rally makes little sense.

Interest rates remain elevated, stocks are near highs, and inflation data is steady. Yet gold — traditionally the hedge against those pressures — is rallying despite them.

There are two main reasons:

1. Central Bank Stealth Accumulation. Several emerging-market central banks, including the PBoC and RBI, have continued discreet gold purchases through over-the-counter channels. While official reserves haven’t moved dramatically, import data reveals consistent tonnage inflows since July.

2. Market Psychology Shifting from Price to Possession. The psychology of this rally is different from 2020 or 2022. Then, gold was a hedge. Now, it’s becoming a preference — particularly in Asia. Investors aren’t chasing returns; they’re rebuilding monetary buffers in an increasingly fractured world.

For mature professionals and civil servants — those who prefer stability to speculation — these developments are instructive rather than alarming.

This is not a “trade” moment. It’s a portfolio recalibration moment.

Here’s why:

This surge in China’s physical participation feels reminiscent of autumn 2008, when gold in yuan terms broke free from its Western benchmarks for the first time. Then, too, it started with a slow premium reversal, followed by record vault inflows and surging OI.

By January 2009, gold had rallied 23%, even as global equity markets continued falling.

Again in October 2022, gold premiums in China turned positive for the first time post-COVID. Within two months, prices had rallied 14%, and trading volume nearly doubled.

Each of these phases shared the same sequence:

1. Discounts turn to premiums.

2. Vault inflows accelerate.

3. Open interest hits new highs.

4. Western investors wake up late.

We’re now between steps two and three.

The signal from Shanghai is unmistakable.

While U.S. investors fixate on the VIX and stock tickers, China is laying the groundwork for gold’s next leg higher — one ounce at a time, under vault lights and settlement screens.

Hugo Pascal captured it best: “When you see premiums flip and vaults fill in the East while volatility rises in the West — that’s not coincidence. That’s the two sides of confidence switching places.”

For those who seek stability rather than speculation, this is precisely when positioning quietly matters most.

Gold is not running away; it’s being repriced, gently, globally, and methodically.

Singapore remains one of the world’s safest, most tax-efficient jurisdictions for gold procurement and storage — fully LBMA-aligned, 0% capital gains, and trusted by investors worldwide. Visit InProved.com to access institutional pricing, secure vault storage, and real-time premium data tracking the world’s most important gold markets.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions