| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

There are weeks when gold sits still like a wise old sentinel. And then there are weeks like this—when vaults shift, volumes roar, and premiums whisper clues louder than headlines.

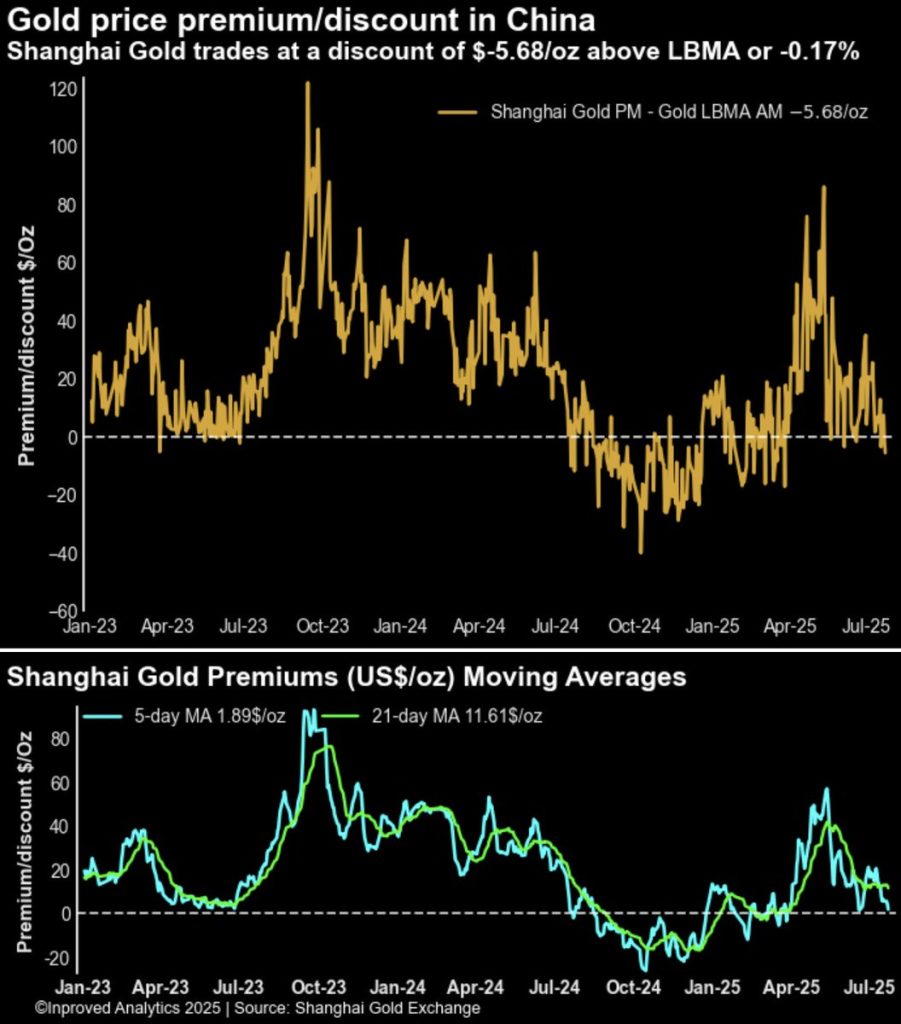

The last seven days have not just been about price, though the numbers are striking enough. Gold closed the week around $3,371/oz in Shanghai, with premiums flipping between positive and negative across sessions—down 0.32% below LBMA levels at one point, as the physical market seemed to cool just enough to raise eyebrows. But in the shadows of these oscillating figures, a more powerful story is building—one that reveals what the vaults and volumes are truly signaling.

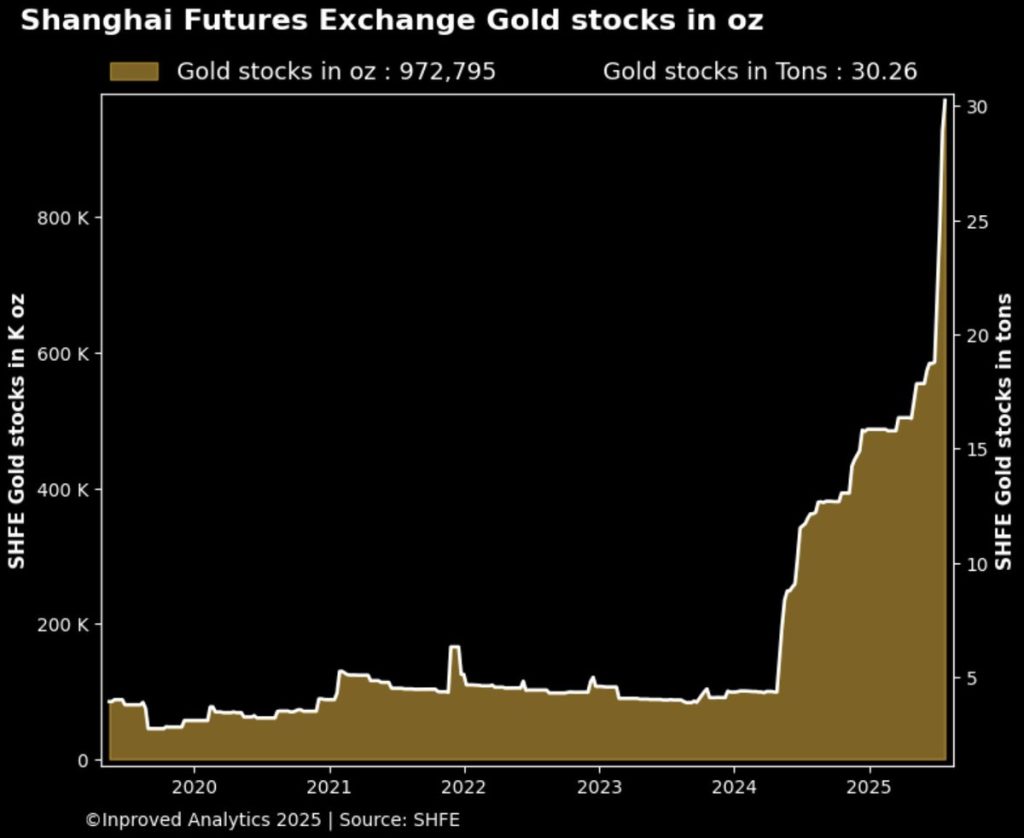

Let’s start with Shanghai. As of July 25, gold vaults in the city hit a new all-time high, up 4.9% on the week to 30.3 tons—an increase of 45,000 ounces in a single week. That brings total year-to-date inflows to over 15 tons, marking a +100% surge since January.

Now, that kind of growth doesn’t happen in a vacuum. It reflects a concerted strategy by domestic traders or institutions to accumulate metal. Whether this is a sign of strategic positioning ahead of volatility, or an internal reallocation of physical liquidity in response to global risk factors, remains speculative—but the scale is unmistakable.

“Accumulation at this pace,” says Hugo Pascal, CIO of InProved Metals, “isn’t about daily trading—it’s about preparing for a macro regime change. Vaults don’t fill themselves without intention.”

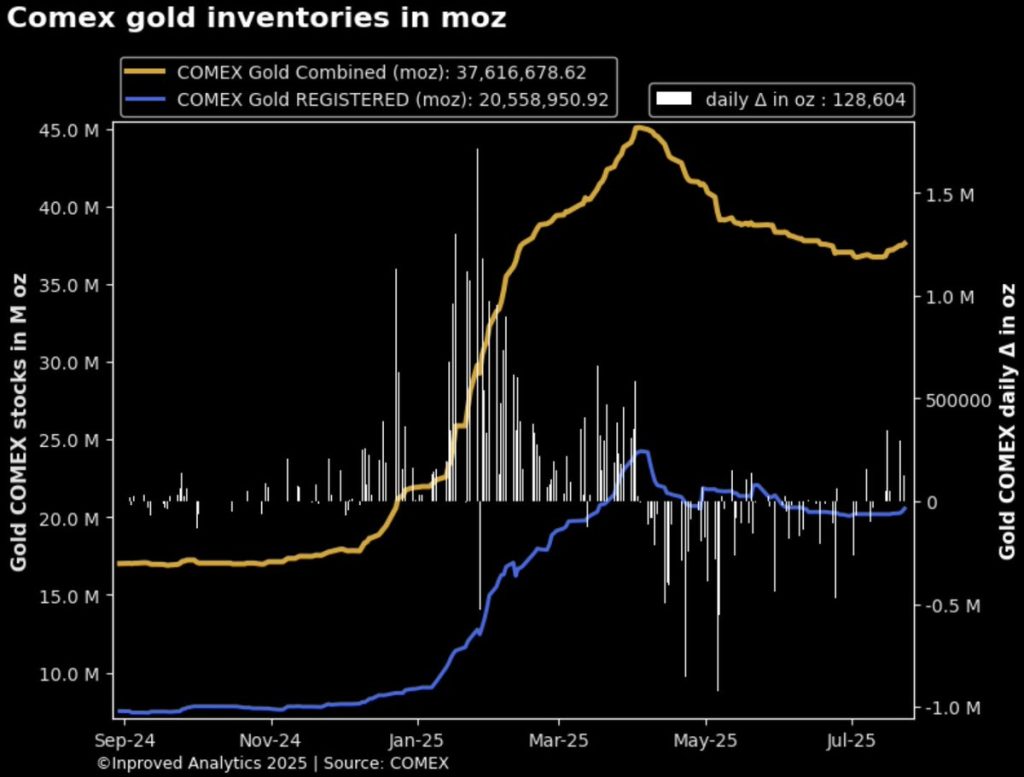

Meanwhile, on the other side of the world, COMEX continues to see a swell in delivery readiness. The registered category—which is composed of metal available for futures delivery—has increased by 320,400 ounces (10 tons) week-to-date, now totaling 20.6 million ounces.

That’s not only a strong buildup—it’s also time-sensitive. With the August ’25 gold contract approaching delivery, this inventory move is not just a logistical flex. It’s a market preparing for actual physical settlement.

In recent years, the majority of COMEX contracts have been rolled, rarely leading to delivery. But when registered metal rises at this pace ahead of expiration, it suggests that a different tone is being set.

It’s not about synthetic leverage anymore. It’s about claims on actual ounces.

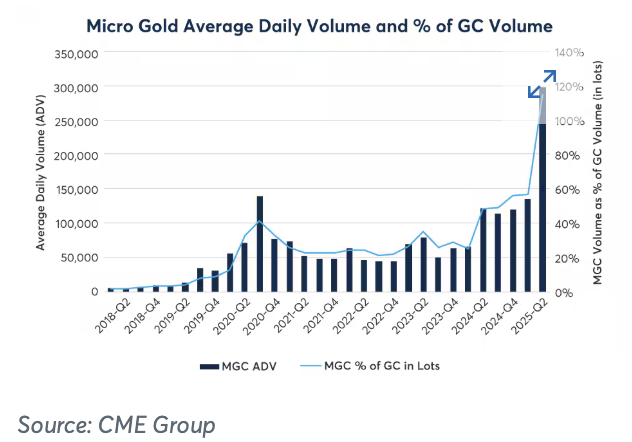

If the vaults are whispering, the CME has been screaming.

Gold derivatives trading reached record levels in the most recent quarter, with average daily volume (ADV) clocking in at 943,000 contracts across metals.

That includes:

This kind of velocity in trading volume isn’t just high-frequency noise. It’s a storm of opinion—market participants on both sides of the spectrum placing bets, hedging delivery, and building layered positions to navigate what’s increasingly a geopolitical and macro-sensitive asset class.

Volatility hasn’t exploded—yet. But positioning tells us it’s being priced in.

In quieter times, premiums in Shanghai tend to hover steadily above LBMA—often reflecting import costs, VAT differences, and local market tightness.

But this week, premiums flipped into negative territory, first on July 24 when they closed -0.2% below LBMA, and then again on July 25, reaching -0.32%. That equated to a $5.7/oz discount, bringing gold’s domestic price in China to $3,371.7/oz.

What does this tell us?

On one hand, it’s a potential indicator of softer demand in the physical market—perhaps traders are pausing to reassess amidst global uncertainty and rising platinum appeal. But on the other hand, such shifts often align with changes in import dynamics or market anticipation of stimulus, currency adjustment, or trade pivot.

Pascal offers his take: “When Chinese premiums flip negative, you’re not looking at a price problem—you’re looking at a positioning opportunity. The smart money waits for these dips to secure metal with tight spreads.”

Hovering above all of this is the broader macro cloud. Treasury yields remain volatile, currency pairs like EUR/USD are increasingly unstable, and geopolitical flare-ups—whether in the Middle East or across Asia—are keeping both bond traders and bullion buyers on edge.

These dynamics are prompting institutions to seek real assets. And despite fluctuations in premiums and sentiment, gold’s status as a strategic hedge remains as relevant as ever.

It’s worth noting a subplot that’s become harder to ignore—the sharp drop in the gold-to-platinum ratio on the Shanghai Gold Exchange. This week it hit 2.29:1, the lowest in a year. Platinum’s recent surge in attention, particularly from industrial buyers and speculative option traders, has begun to peel away some of the shine from gold.

But the rotation isn’t necessarily bearish. It’s simply reflective of the larger dance in the precious metals complex. As one metal consolidates, another takes the lead.

Gold isn’t weakening—it’s repositioning.

Whether you’re a futures trader, ETF holder, or physical stacker, the signals this week are clear: the market is preparing for a larger event.

That event may not hit next week. It might not even come this quarter. But when vaults are being stocked, when registered categories rise ahead of expiry, when volumes break records, and when premiums go from positive to negative within hours, the writing is on the wall.

Pascal sums it up best: “These aren’t red flags. They’re breadcrumbs. And they lead to one conclusion—the market is pricing in a move before the year is out.”

For those looking to build or protect wealth through bullion, these moments are crucial. You don’t chase the hype—but you prepare through structure.

That’s why at InProved, we focus on delivering some of the world’s lowest LBMA-priced physical gold and silver, all fully allocated and stored in Singapore’s secure vaults. You can track real-time premiums between Shanghai and London, monitor options skew and macro flows, and execute trades—all from our intuitive mobile app.

Secure your bullion now with InProved. Visit InProved.com or download our mobile app to start stacking real gold, in the safest jurisdiction in Asia.

Because when vaults are talking, you want to be listening.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions