| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

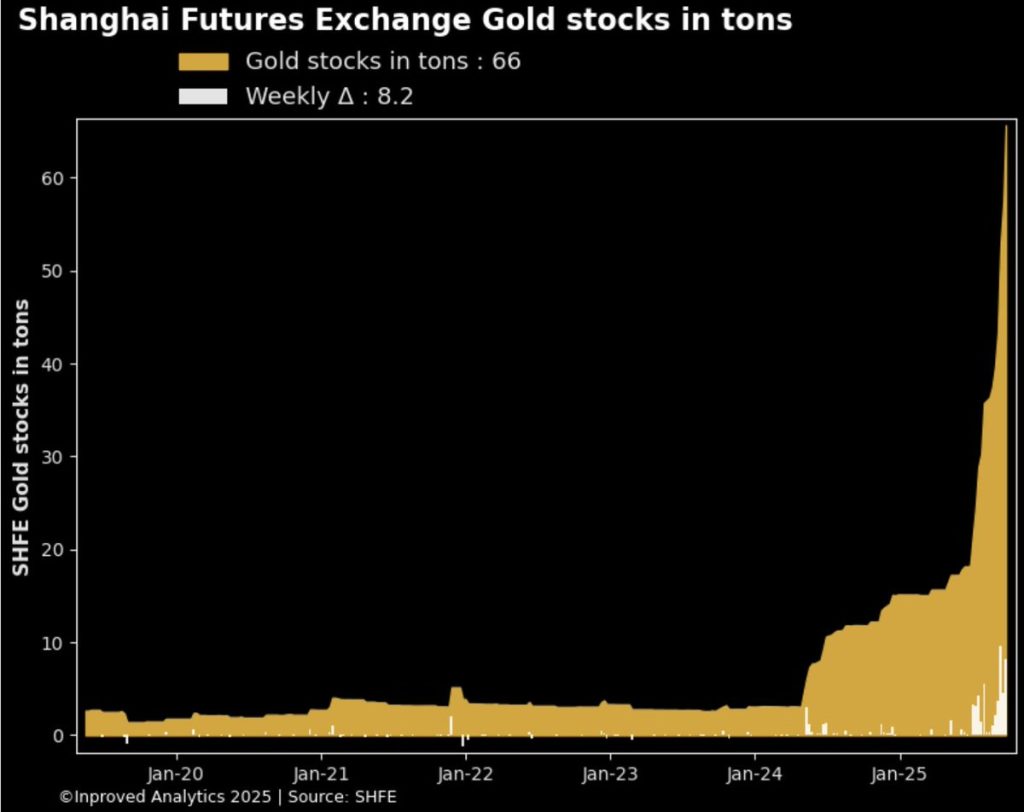

Gold has always been a paradoxical metal. It is both an anchor of stability and a barometer of uncertainty. And right now, the paradox is sharper than ever. In China, the world’s largest consumer of physical bullion, gold continues to trade at a discount to the London Bullion Market Association (LBMA) benchmark, closing last Friday nearly -0.9% below London prices. At the very same time, Shanghai vaults are reporting record-breaking inflows, with holdings now surpassing 66 tons (2.1 million ounces) — the highest level in history.

The combination is unusual, even contradictory: relentless inflows into vaults on one side, and persistent discounts on the other. The natural question is whether these dynamics foreshadow an inflection point in gold pricing — a structural tightening of supply, or merely a temporary dislocation between paper and physical markets.

The numbers out of China in late September are startling. The Shanghai Gold Exchange (SGE) and Shanghai Futures Exchange (SHFE) vaults absorbed 8.2 tons of gold in a single week, the second-largest weekly increase ever recorded. On Thursday alone, the inflow reached 5 tons, pushing total holdings to 66 tons, marking a staggering 260% year-to-date rise.

Yet despite these aggressive inflows, the local premium that usually signals strong demand flipped into discount. Gold in Shanghai has been trading between -0.7% and -0.9% below LBMA benchmarks, equivalent to a $25–35 per ounce discount.

This is not without precedent. During 2013, when China’s imports surged after prices collapsed, discounts persisted for months. More recently, in 2022, as capital controls tightened and yuan weakness weighed on investor sentiment, Shanghai premiums narrowed into discounts despite heavy vault buying.

Analysts point to two overlapping dynamics:

In other words, the vault data suggests preparation for the long term, while the discount reflects hesitation in the present.

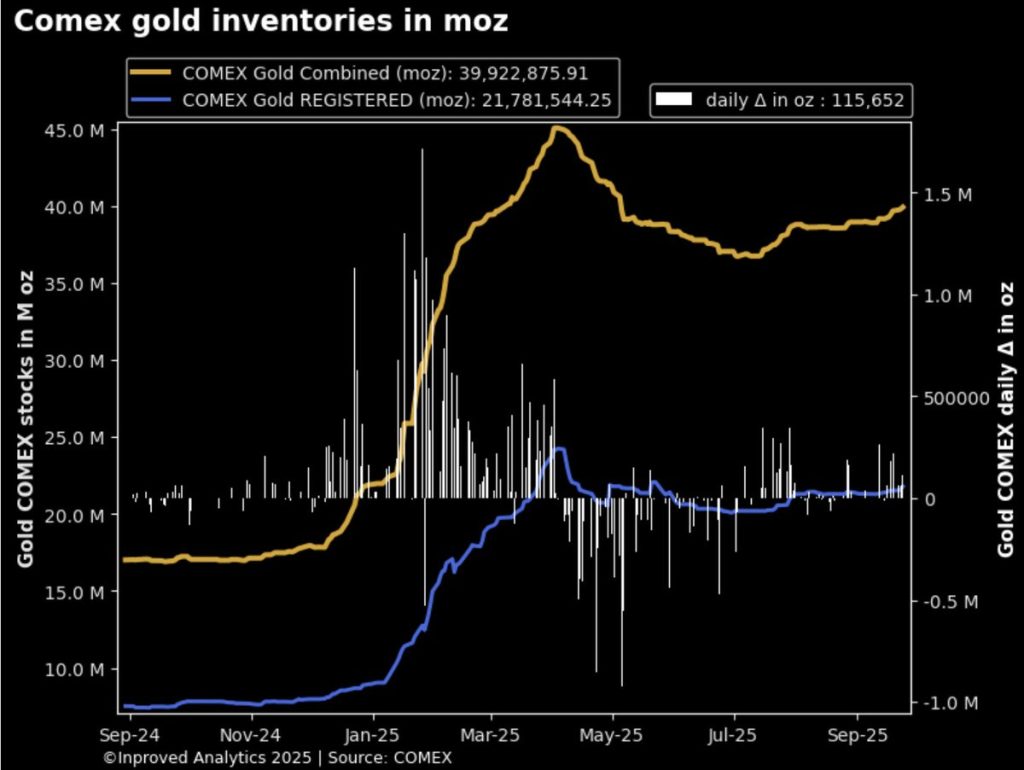

Across the Pacific, COMEX warehouses in New York are swelling again, with gold stocks climbing toward a five-month high of nearly 40 million ounces. Inflows of nearly 7 tons in a single week show that metal is steadily flowing into deliverable stockpiles, even as futures volumes remain heavy.

But here, too, the picture is more complex. Only a portion of those 40 million ounces sit in the registered category — deliverable metal for futures contracts. Eligible stocks, while physically present, may not be immediately available for delivery.

History has shown why this matters. In 2011, when gold surged to $1,920, COMEX appeared flush with inventory, but the registered portion had thinned dramatically. That mismatch amplified volatility once delivery demand surged. The same risk lurks today.

In each case, vault inflows at discounts proved transitional. When macro or currency conditions stabilized, premiums came back — often heralding global rallies.

China is stacking gold at unprecedented levels, yet discounts persist. It’s as if two markets are coexisting: one in which long-term players hoard, another where short-term investors hesitate.

That tension cannot last forever. Either premiums will return as demand catches up, or inflows will slow. Historically, vault accumulation has been the truer signal.

For conservative investors — civil servants, matured PMETs, or those prioritizing steady wealth preservation — this environment is not a call to speculate but to act with discipline.

Discounts to LBMA are rare. In 2013, 2018, and 2022, investors who used these windows to gradually accumulate physical bullion preserved and later grew wealth. By contrast, those who waited for sentiment to improve often bought back in at higher premiums.

As Hugo Pascal recently remarked, “Gold doesn’t care about today’s premium or discount. It cares about the direction of trust.” For conservative investors, that means measured accumulation while others hesitate.

Gold at a discount in China while vaults overflow is not a contradiction — it’s a signal. History suggests such moments precede renewed premiums and higher global prices.

For long-term, conservative investors, this is the time to quietly keep stacking, using Singapore’s unique tax and vault advantages. When the discount finally flips, today’s buyers will already be positioned for the next leg higher.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions