| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

| Procure investment-grade 1kg gold bars at spot +0.25%. Enquire within. |

In a market dominated by noise—geopolitical headlines, inflation data, central bank commentary—gold’s recent moves have been anything but loud. Yet, beneath the surface, there’s a structural shift taking place that could set the tone for the rest of Q3.

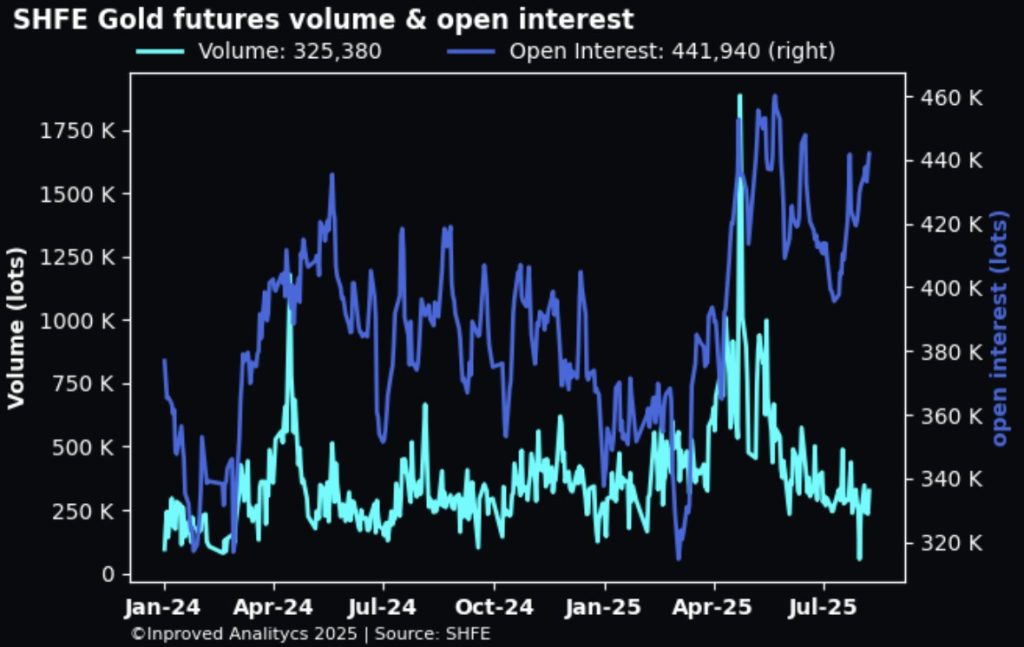

On the Shanghai Futures Exchange (SHFE), gold closed 0.56% higher at ¥787.80 per gram—the COMEX equivalent of $3,411.24 per ounce. More important than the price itself was the market structure: open interest surged to a two-month high of 441,940 contracts, equivalent to 442 tons. For context, that’s more than double the registered inventory in COMEX vaults.

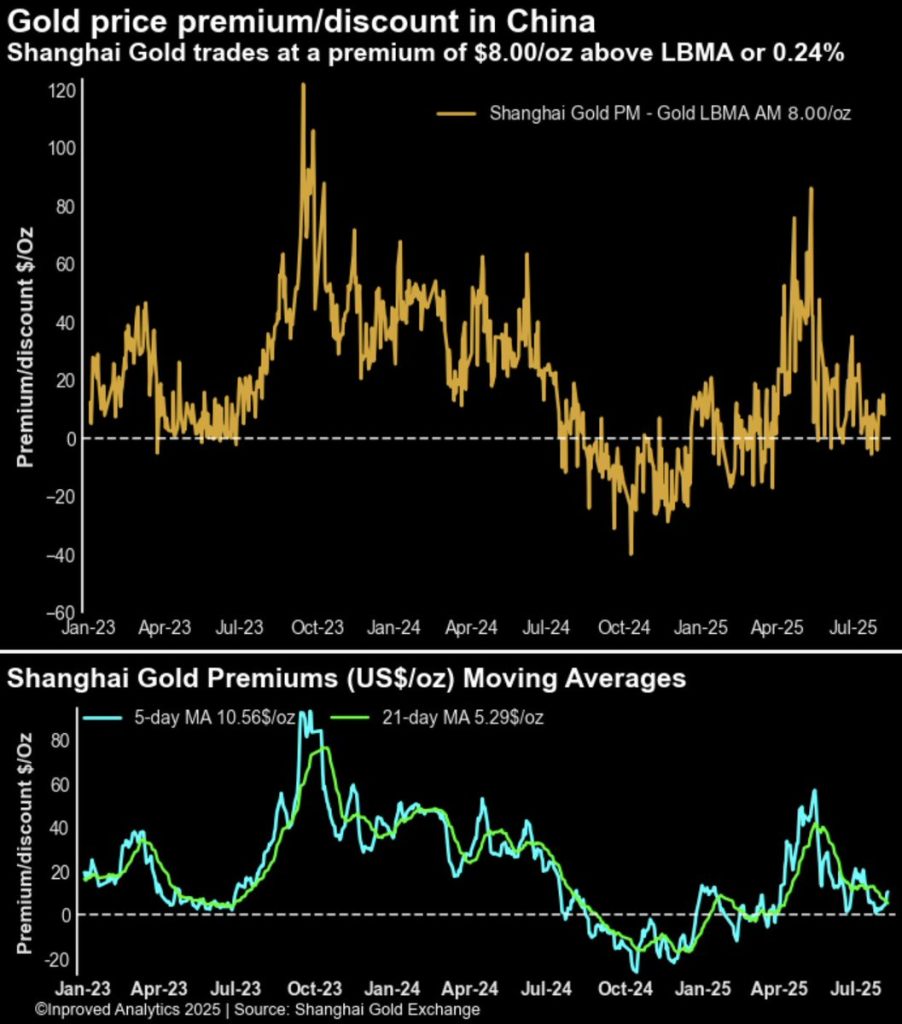

Gold premiums in China remain steady, trading at +0.25% above the LBMA benchmark, which translates to about $8 per ounce. This premium stability suggests that despite recent price consolidation, physical demand is quietly persistent.

And the vault data backs it up. Both gold and silver stocks in London vaults continue to climb. Gold holdings rose 1.02% month-on-month to 8,865 tonnes, while silver climbed 1.7% MoM to 24,199 tonnes. The slow, steady rise in Western vaults tells a different story than the headline price action—it’s accumulation season, just without the fireworks.

“People forget that vault flows are the heartbeat of the bullion market,” I noted this week on X. “Prices can be noisy, but flows are deliberate.”

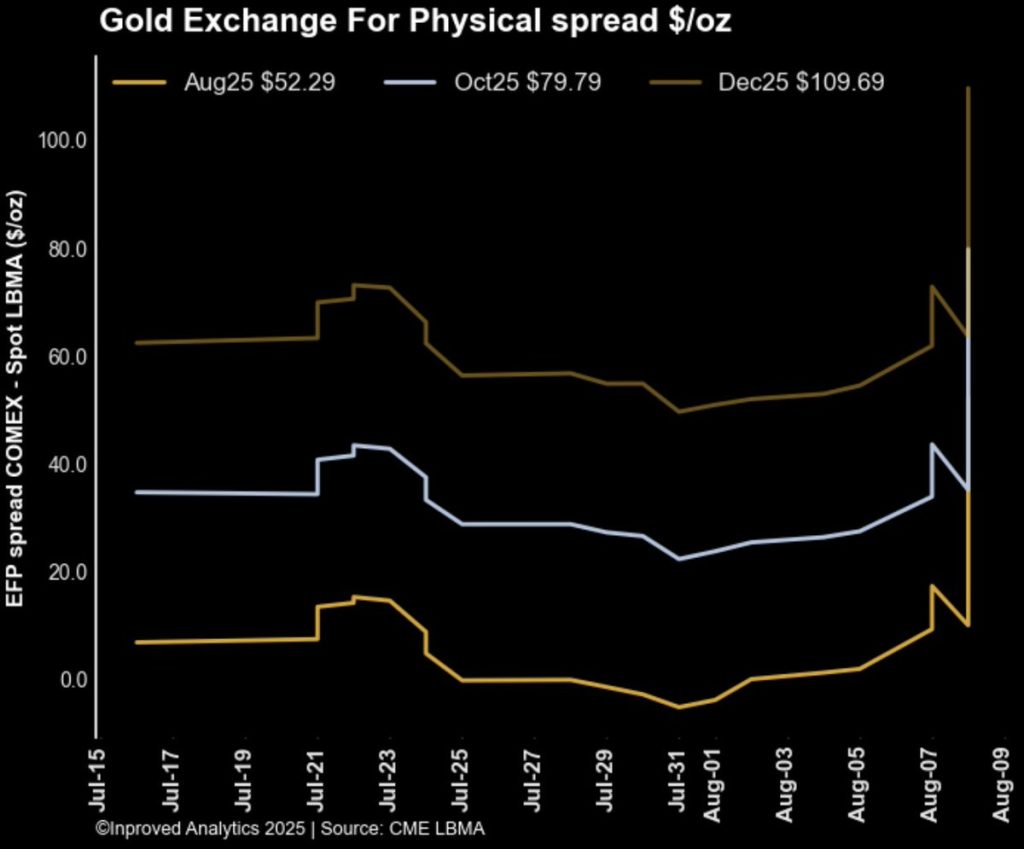

Perhaps the most underappreciated development this week has been the widening of gold EFP (Exchange for Physical) spreads, triggered by U.S. tariffs on gold bars from Switzerland. These tariffs, aimed at kilo bars and 100oz bars, have effectively injected friction into one of the most established supply chains in the global bullion market.

EFPs are the bridge between paper futures and physical delivery. When spreads widen, it’s often a sign of dislocation between the futures price and the spot market. In this case, it’s not a shortage—it’s logistics. The market is now pricing in the added cost and time required to source compliant bars. That’s an undercurrent worth watching because if premiums spike alongside tariffs, it could ignite arbitrage flows from Asia into the U.S.

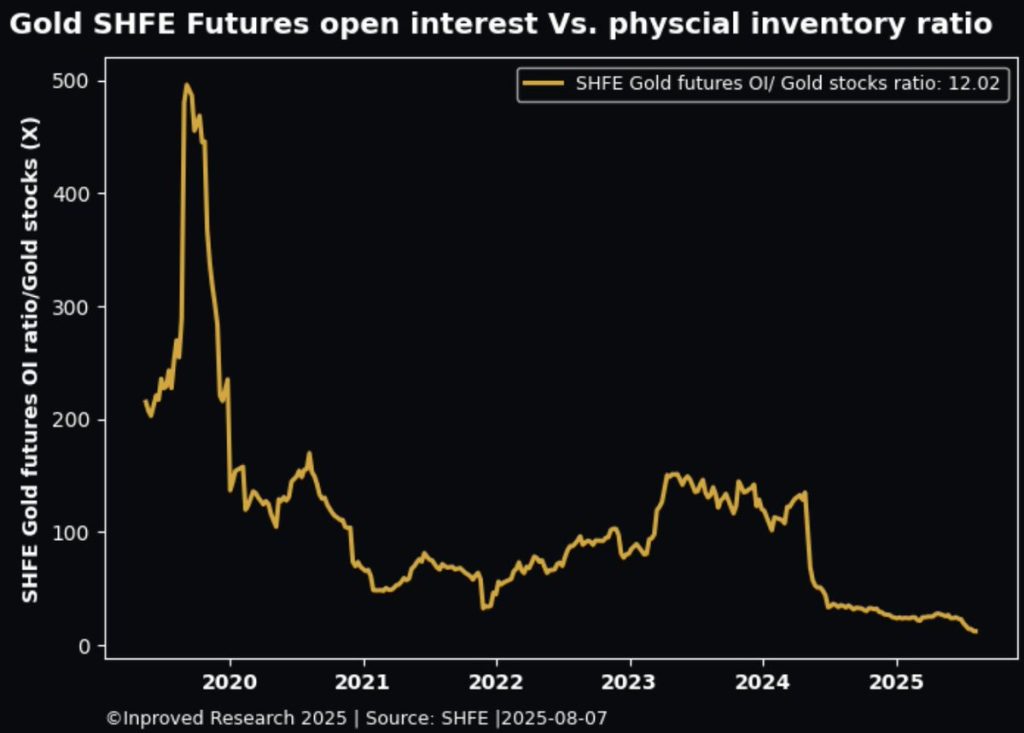

Right now, the SHFE gold futures open interest-to-inventory ratio stands at 12:1—meaning there are 12 ounces of paper claims for every ounce of deliverable physical gold in Shanghai vaults. Over in New York, COMEX shows 451,685 contracts open (45.2 million ounces) against just 21.3 million ounces of registered gold, a ratio of 2.12:1.

These ratios aren’t inherently alarming—futures markets always operate with leverage—but they do highlight how quickly things could tighten if delivery demand were to spike unexpectedly. When coupled with stable-to-rising premiums in China and vault growth in London, it creates a picture of a market where physical backing is still there, but much of the action is concentrated in leveraged paper positions.

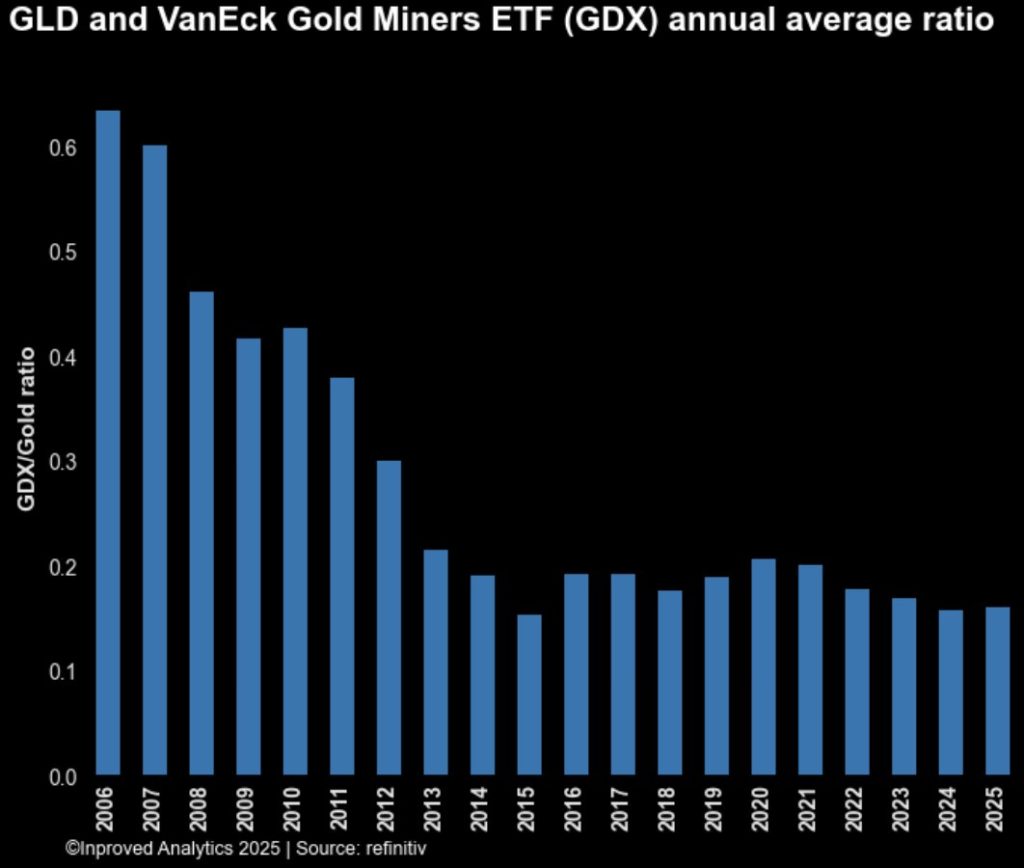

Then there’s the miner’s metric—the VanEck Gold Miners ETF (GDX) to SPDR Gold Trust (GLD) ratio. This week, it hit a two-year high at 0.181, still just a hair below its 10-year and 20-year average of 0.182. Historical norms tell us that over a 20-year period, that ratio averages closer to 0.28. If the ratio were to revert fully, GDX would be trading around $87 per share, compared to current levels well below that.

In other words, the miners are still heavily discounted relative to the metal. If gold can sustain its footing above $3,400 and push toward its seasonal Q4 strength, miners could offer a leveraged upside play.

Shanghai’s role in this quiet gold build-up cannot be overstated. As of August 6, Shanghai gold vaults hit a new high at 36.05 tonnes, up significantly on the year. This is not speculative futures activity—it’s physical bullion in one of the most closely watched vault systems in the world.

And while trading volumes in the AU9999 contract have been uneven in recent months, vault holdings continue to rise, suggesting that buyers are more interested in stacking bars than chasing price swings.

Gold is in a strange position—it’s not flashing a speculative mania, but its internals are tightening. Premiums are steady, vault holdings are rising, and paper-to-physical ratios are high but not at stress levels. Add in the U.S.-Swiss tariff wrinkle, and we may see some subtle but important shifts in global bullion flows over the next few weeks.

For long-term allocators, these are accumulation conditions—times when the market is quietly laying the groundwork for its next move. For traders, low volatility means options strategies are cheap, and for physical stackers, premiums remain reasonable in key hubs like Singapore.

As I’ve been saying for months: “Gold doesn’t need a crisis to go higher—but it often uses one as an excuse.” The structure is here. All it needs now is the spark.

If you want to secure your wealth in physical bullion with some of the lowest LBMA prices in the world, backed by Singapore’s unmatched tax efficiency and security, download the InProved mobile app today or visit InProved.com. In a market where vaults are filling quietly, the smartest move is to make sure yours is one of them.

Hugo Pascal’s observation about the AU9999 contract hitting a 10-week volume high underscores the increasing significance of physical gold trading on the Shanghai Gold Exchange. This trend not only highlights robust domestic demand in China but also reflects broader shifts in the global gold market toward physical-backed assets.

About Us

Information

Individual Solutions

Commercial Solutions